Our pets are part of our family. Naturally, we’d want to give them insurance, just like we provide insurance for the members of our families. Although many pet owners decide to buy pet health insurance to protect their pets in the situation of a crisis what happens if your pet’s actions cause harm to someone else? […]

The art of character design for animation is a complex and multifaceted endeavor that requires careful consideration of various elements, including figure proportions. The way characters are physically portrayed on screen can greatly impact their overall aesthetic appeal and the audience’s emotional connection to them. This article aims to provide artistic insights into figure proportions […]

Animation is an intricate art form that brings life to still images through the clever manipulation of movement and time. Within this realm, two fundamental techniques play a pivotal role in creating realistic and dynamic animations: follow through and overlapping action. These techniques involve the careful consideration of how different parts of an animated object […]

Drawing techniques play a crucial role in the fields of arts, animation, and character design. Artists and animators employ various methods to capture their imagination on paper or digital platforms, creating visually captivating works that communicate narratives and emotions. These techniques encompass a wide range of skills, from mastering basic drawing fundamentals to advanced rendering […]

Cubism, a pioneering art movement that emerged in the early 20th century, revolutionized artistic expression and challenged traditional notions of representation. This article explores the influence of Cubism on both visual arts and animation, examining how this avant-garde style has shaped artistic techniques and narratives. By delving into the key characteristics and principles of Cubist […]

Animation has become an increasingly popular medium for artistic expression, captivating audiences with its ability to bring imagination to life. However, despite the growing demand for animated content, many talented animators find themselves facing financial barriers that hinder their creative pursuits. This article aims to explore the concept of a “Creativity Finance Hub,” a unique […]

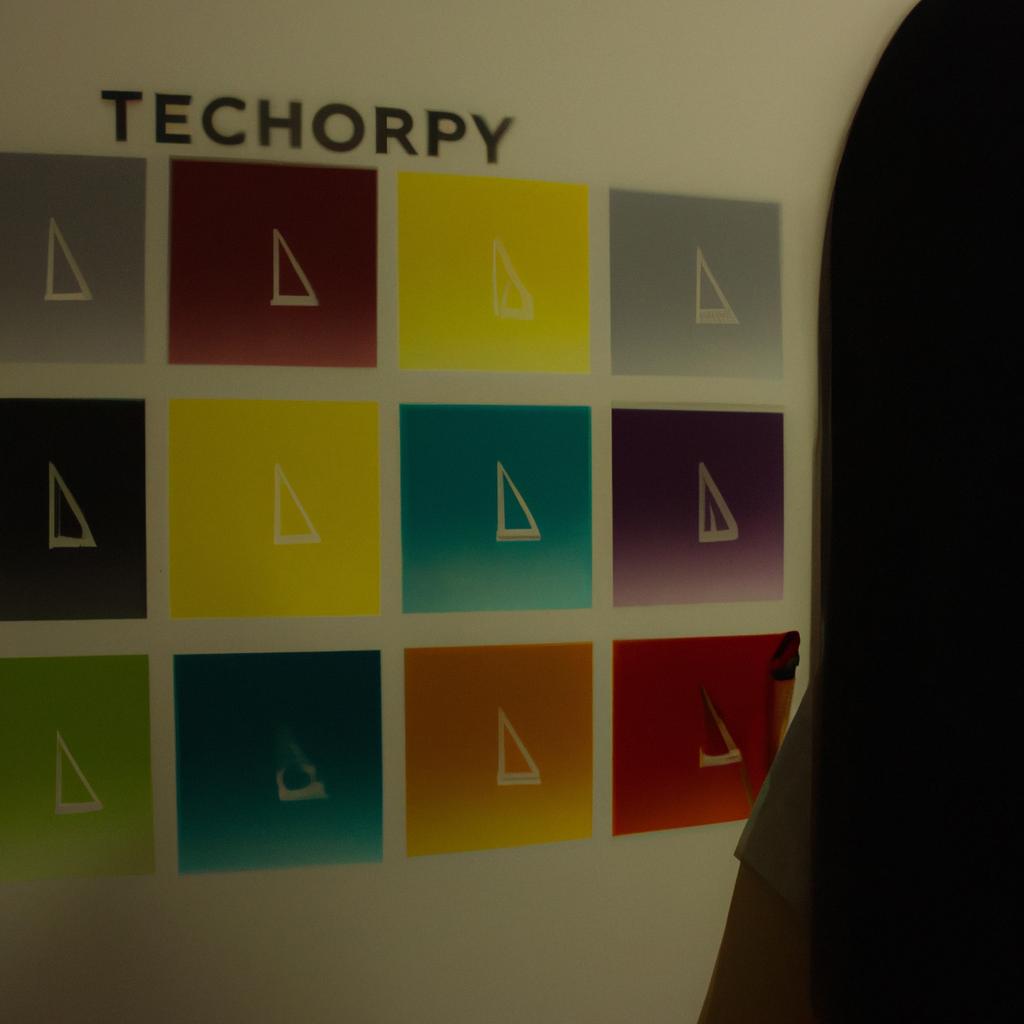

Color theory is a fundamental aspect of arts and animation, serving as a crucial tool for artists to convey emotions, create visual harmony, and evoke specific responses from viewers. Understanding the principles of color theory allows artists to manipulate colors effectively, resulting in impactful compositions that resonate with audiences. For instance, consider an animated film […]

Art styles play a significant role in the field of arts and animation, showcasing diverse techniques and aesthetics employed by artists to express their creativity. These styles encompass various elements such as composition, color palette, brushwork, and overall visual representation. For instance, consider the case of “Impressionism,” an art movement that emerged in the late […]

Transitions are an essential aspect of arts and animation storyboarding, playing a crucial role in the seamless flow of visual narratives. They serve as bridges between scenes, guiding viewers through various emotions and plot developments. Understanding how to masterfully employ transitions can elevate storytelling to new heights, captivating audiences and immersing them within the world […]

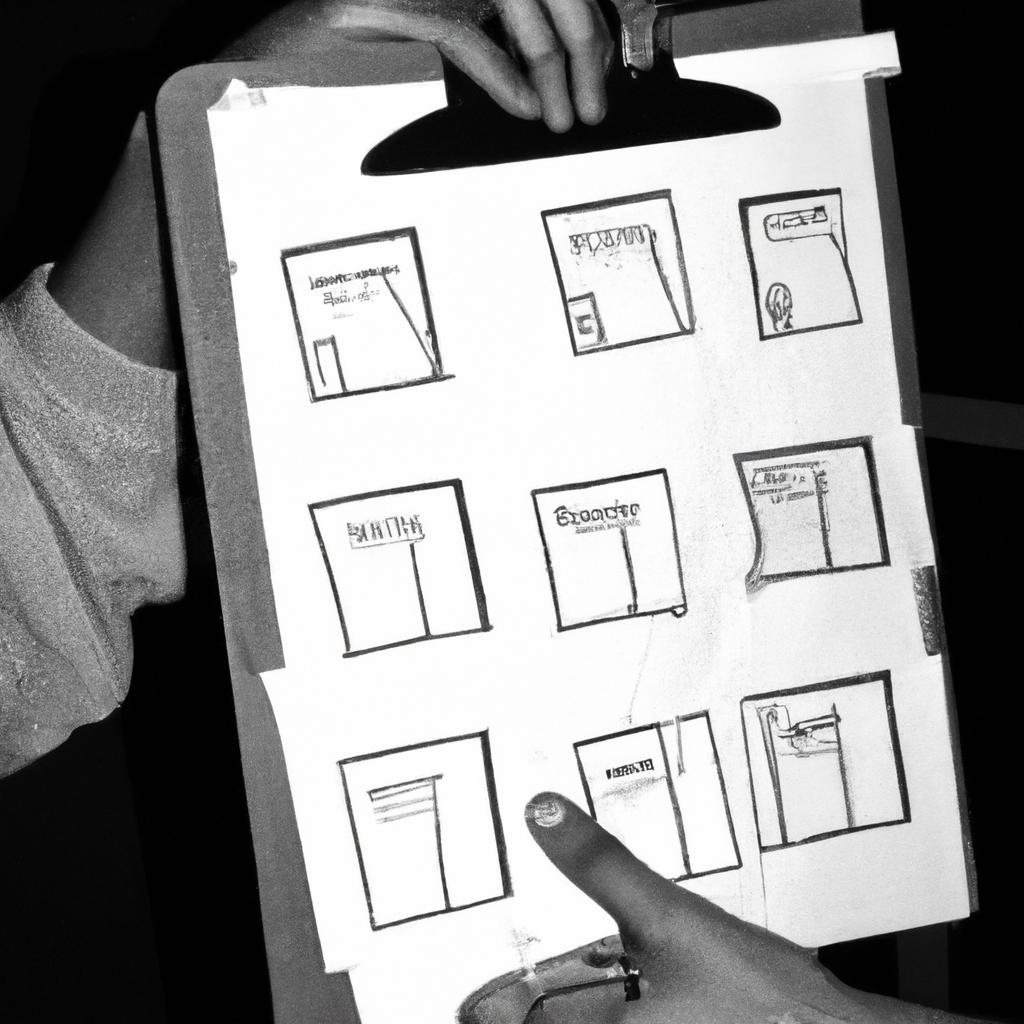

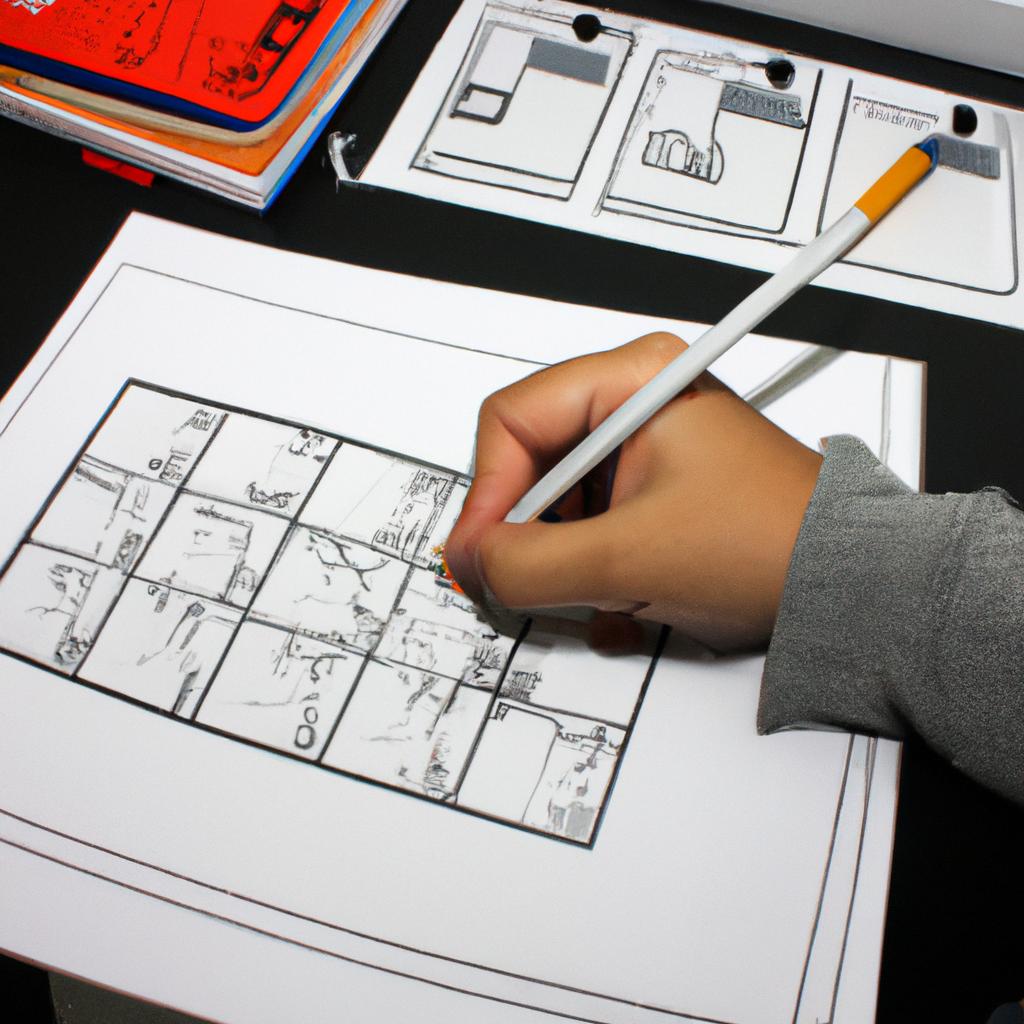

Storyboard layout plays a critical role in the realm of arts and animation, serving as a powerful tool for effective storytelling. By visually mapping out the sequence of events within a narrative, storyboard artists are able to craft compelling stories that not only engage audiences but also guide the creative process from concept to completion. […]

In the world of animation, one technique stands out for its ability to bring life and character to inanimate objects: squash and stretch. This fundamental principle has been employed by animators since the early days of hand-drawn animation, and continues to be a cornerstone of modern computer-generated imagery (CGI). Squash and stretch refers to the […]

The use of color in arts and animation plays a fundamental role in creating visually captivating and emotionally evocative works. Artists and animators carefully consider the principles of color theory to effectively communicate their intended messages, elicit specific moods or emotions from viewers, and enhance overall visual appeal. This article explores the concepts behind color […]

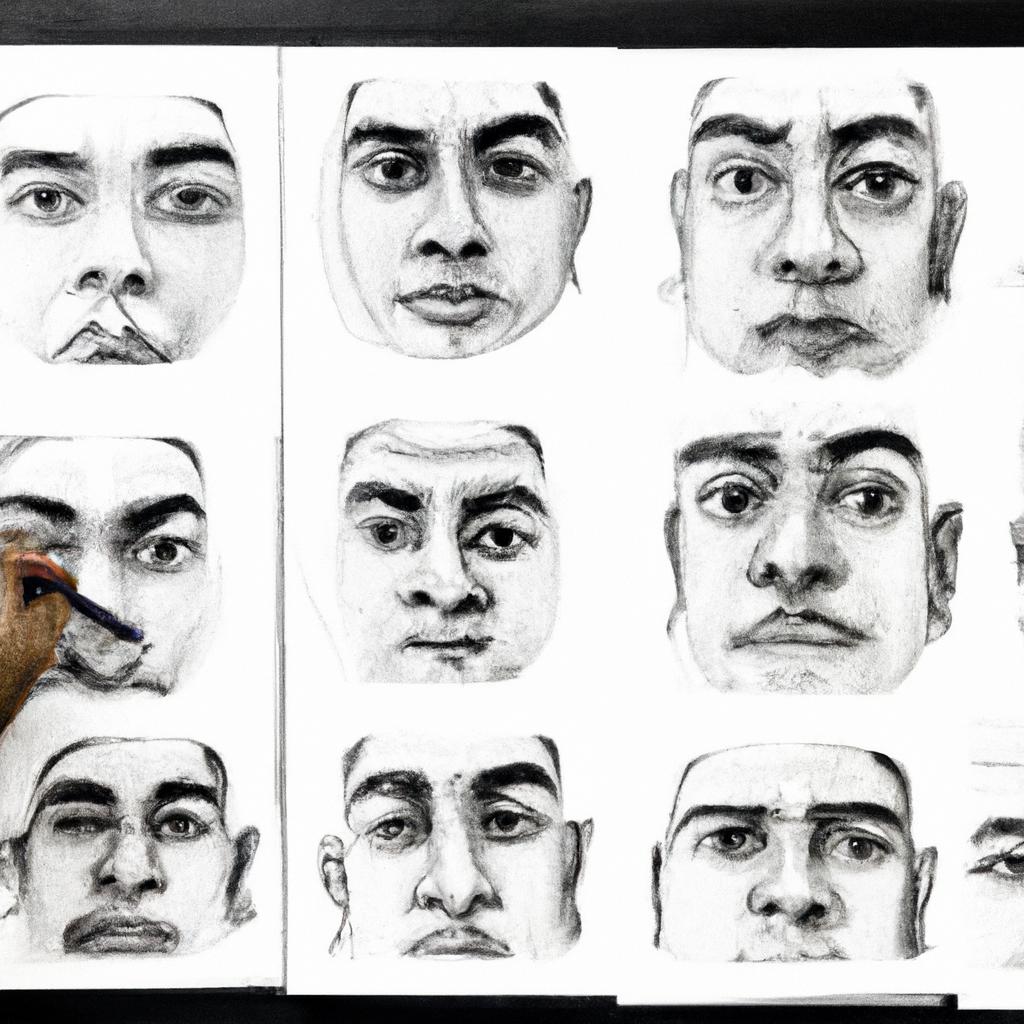

Facial expressions play a vital role in the realm of arts and animation, particularly in character design. They serve as powerful visual cues that convey emotions, thoughts, and intentions of characters to the audience. By manipulating facial features such as eyebrows, eyes, mouth, and overall facial structure, artists and animators have the ability to create […]

Narrative flow is an intricate and vital element in the creation of arts and animation. It serves as a guiding force that allows for seamless storytelling, captivating audiences through its ability to convey emotions, ideas, and messages effectively. Storyboarding plays a crucial role in achieving narrative flow by providing a visual blueprint that maps out […]

The art of character design plays a crucial role in the world of animation and visual storytelling. It is through these meticulously crafted characters that narratives come to life and emotions are conveyed effectively. One powerful technique used by artists and animators is gesture drawing, which involves capturing the essence and movement of a subject […]

Motion capture technology has revolutionized the world of arts and animation, providing a powerful tool for enhancing creativity in various fields. One real-life example that showcases the transformative potential of motion capture is its application in the finance hub industry. By utilizing this technology, financial institutions can create visually engaging and informative presentations to effectively […]

Storyboarding is a fundamental technique employed in the fields of arts and animation, serving as a visual blueprint for creative projects. By breaking down complex narratives or ideas into sequential images, storyboarding aids artists and animators in effectively communicating their vision to others involved in the production process. For instance, imagine an animator working on […]

Animation is a dynamic art form that has captivated audiences for decades. Through the use of various techniques, animators bring characters and stories to life on screen. In this article, we will explore different artistic animation methods employed by professionals in the industry. By examining a case study of the acclaimed animated film “Toy Story,” […]

Color plays a vital role in the world of arts and animation, where hues are carefully chosen to evoke emotions, create atmosphere, and convey meaning. Understanding color theory is essential for both artists and animators, as it provides them with the tools to effectively manipulate colors and harness their psychological impact. This article explores the […]

Pointillism, a distinct artistic style characterized by the use of small dots or points to create an image, has been widely celebrated for its unique and captivating visual effects. This technique was pioneered by Georges Seurat in the late 19th century and has since influenced various art forms, including animation. By strategically placing individual dots […]

In the bustling world of finance, where numbers and data take center stage, it may seem unlikely to find a place for creativity. However, sound design in arts and animation has proven to be an unexpected avenue through which financial institutions can unleash their creative potential. Take, for example, the case study of a prominent […]

Camera angles play a crucial role in arts and animation, serving as a visual storytelling tool that allows artists to convey emotions, perspectives, and narratives effectively. By manipulating the position and orientation of the camera relative to the subject matter, artists can create dynamic compositions that engage viewers and enhance their understanding of the artwork […]

Animation is a captivating form of visual storytelling that has evolved over the years. Among the various techniques employed in animation, one technique that holds significant importance is “slow out.” Slow out refers to the concept of gradually reducing speed as an animated object comes to rest, creating a smooth and realistic motion. Understanding this […]

Surrealism in arts and animation is a captivating artistic movement that emerged in the early 20th century. It challenges conventional notions of reality by exploring dreamlike, illogical, and subconscious elements within artworks. This article aims to delve into the surreal art styles used in this movement, shedding light on their distinctive characteristics and influential figures. […]

Staging is a crucial element in both arts and animation, serving as the foundation upon which storytelling and visual communication are built. It involves the deliberate arrangement of characters, objects, and elements within a scene to effectively convey emotions, actions, and narrative progression. By strategically employing various animation techniques, artists can enhance the impact of […]

Animation is an art form that has captivated audiences for decades. It possesses a unique ability to bring characters and stories to life, captivating viewers of all ages. From classic hand-drawn animations like Disney’s “Snow White and the Seven Dwarfs” to modern computer-generated marvels such as Pixar’s “Toy Story,” animation techniques have evolved over time, […]

The world of arts and animation is a vibrant realm where creativity knows no bounds. Among the various elements that contribute to the visual impact of these mediums, color holds a significant position. Understanding the role of color in creating compelling works requires an exploration of color theory principles, such as saturation. Saturation refers to […]

Tertiary colors are an integral part of color theory in arts and animation, providing a broad array of possibilities for artists and animators to explore. By combining primary and secondary colors, tertiary colors offer a wide range of hues that can evoke various emotions and create visual depth. For instance, imagine an animated film where […]

Creating captivating and memorable characters is an essential aspect of arts and animation. Whether it be in films, video games, or even advertising campaigns, character design plays a crucial role in capturing the attention and imagination of audiences. Employing various techniques and principles, artists and animators bring these characters to life on screen or canvas, […]

Virtual Reality (VR) has emerged as a powerful tool in the field of arts and animation, providing new avenues for creativity and expression. By immersing users in virtual environments, VR technology offers artists and animators an innovative way to explore their imaginative ideas and bring them to life. This article aims to examine the impact […]

Keyframes: The Artistic Essence of Animation and Storyboarding In the realm of animation, keyframes serve as a vital component that breathes life into still illustrations. These carefully crafted frames act as pivotal moments in an animated sequence, capturing the essence of movement and emotion. By strategically placing these keyframes throughout the timeline, animators are able […]

Dadaism, an avant-garde art movement that emerged in the early 20th century, remains a significant influence on contemporary arts and animation. Characterized by its rejection of traditional artistic conventions and emphasis on irrationality and absurdity, Dadaism challenged established notions of art and sought to provoke viewers through unconventional means. This article aims to provide an […]

Impressionism, a prominent art movement that emerged in the late 19th century, continues to captivate audiences today with its unique style and technique. This article explores the intersection of impressionism and animation as an innovative approach to understanding and appreciating this artistic tradition. By examining how animation can mimic the brushstrokes and color palettes of […]

The concept of lightness in arts and animation is a fundamental aspect that shapes the visual experience and perception of color. Through the application of color theory, artists and animators can manipulate lightness to convey various emotions, create depth, and evoke specific moods within their works. This article aims to explore the intricate relationship between […]

Expressionism in arts and animation is a vibrant art style that seeks to convey emotions, feelings, and subjective experiences through exaggerated forms, bold colors, and distorted perspectives. This artistic movement emerged in the early 20th century as a response to the growing industrialization and societal changes of the time. One example that epitomizes expressionism in […]

Storyboarding is a crucial step in the process of creating an animated film or television show. It serves as a visual blueprint, allowing animators to plan and organize their narrative before production begins. One example that highlights the importance of composition and artistic harmony in storyboarding can be seen in the critically acclaimed animated film […]

Animation is a captivating form of visual storytelling that has the power to engage and captivate audiences across different mediums. One essential element in creating dynamic and lifelike animations is anticipation, which refers to the preparation or buildup before an action takes place. Anticipation plays a significant role in enhancing the realism and impact of […]

Color theory is an essential aspect of arts and animation, providing artists and animators with a comprehensive understanding of how colors interact and create visual harmony. The study of secondary colors, in particular, plays a crucial role in color theory as it explores the blending and combination of primary colors to form new hues. By […]